davis county utah sales tax rate

The total sales tax rate in any given location can be broken down into state county city and special district rates. You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext.

Georgia Sales Tax Rates By County

You are now able.

. Welcome to the all new Davis County Property Search we have re-written this application to make it easier for you to search for parcels in the county. May 17th 2023 1000 am - Pre-registration starts at 900 am. The 725 sales tax rate in Layton consists of 485 Utah state sales tax 18 Davis County sales tax 01 Layton tax and 05 Special tax.

2020 rates included for use while preparing your income tax deduction. 93 rows This page lists the various sales use tax rates effective throughout Utah. Either the Combined Sales and Use tax.

Davis County Treasurer encourages efforts to maintain critical government services AND to protect the health of the public and our employees. 7705 or email to. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors.

There is no applicable city tax. The most populous location in Davis County Utah is Layton. The latest sales tax rates for cities in Utah UT state.

As far as other cities towns and locations go the place with. We encourage payment of property taxes on this website see link below or IVR payments at 877 690-3729 Jurisdiction Code 5450. Mobile and manufactured homes may be subject to tax sale when the outstanding taxes are one year delinquent.

See Publication 25 Sales and Use Tax General Information. UT Rates Calculator Table. 271 rows Utah has state sales tax of 485 and allows local governments to collect a local.

The 725 sales tax rate in Bountiful consists of 48499 Utah state sales tax 18 Davis County sales tax and 06 Special tax. The 2023 Davis County Delinquent Tax Sale will be held. To find out the amount of all taxes and fees for your.

Tax Rates Subject to Streamline Sales Tax Rules OTHER TAXES APPLY TO CERTAIN TRANSACTIONS Rates In effect as of April. The average cumulative sales tax rate between all of them is 724. This rate includes any state county city and local sales taxes.

We encourage payment of. 2020 rates included for use while preparing your income tax deduction. UTAH CODE TITLE 59 CHAPTER 12 - SALES USE TAX ACT.

Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. 095 lower than the maximum sales tax in UT. Davis County collects on average 06 of a propertys assessed fair market.

Tax rates are also available online at Utah Sales Use Tax Rates or you can. Utah has a 485 sales tax and Davis County collects an additional 18. UTAH CODE TITLE 59 CHAPTER 12 SALES USE TAX ACT RATES APPLIED TO CERTAIN TRANSACTIONS Rates In effect as of April 1 2022.

Davis County Administration Building Room 131. If you have questions please call 801-451-3243. The sales tax jurisdiction name.

Rates include state county and city taxes. Annually a public auction is held for any property which has delinquent taxes. The median property tax in Davis County Utah is 1354 per year for a home worth the median value of 224400.

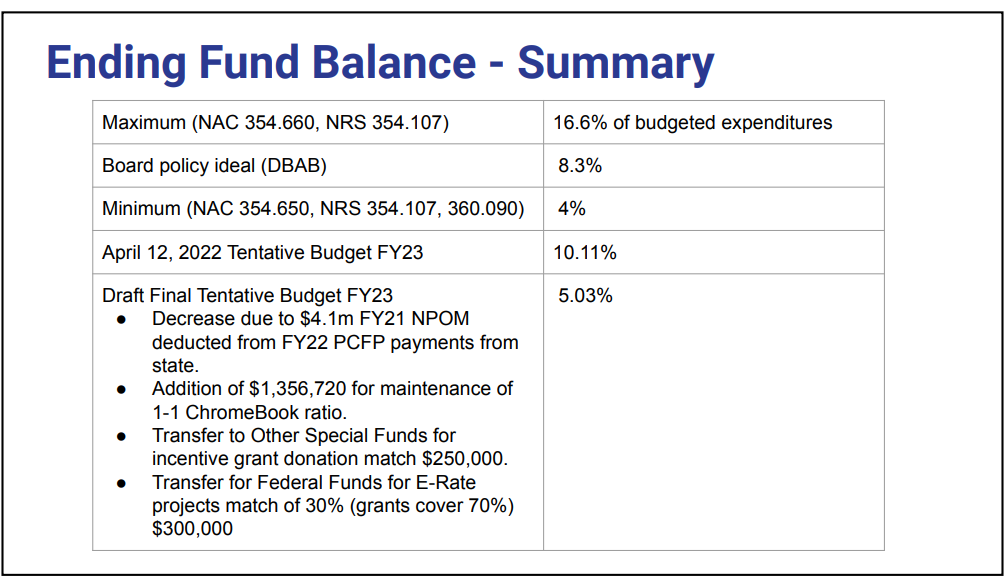

State Yanks 4 1 Million In Mine Tax Money From School Budget Government And Politics Elkodaily Com

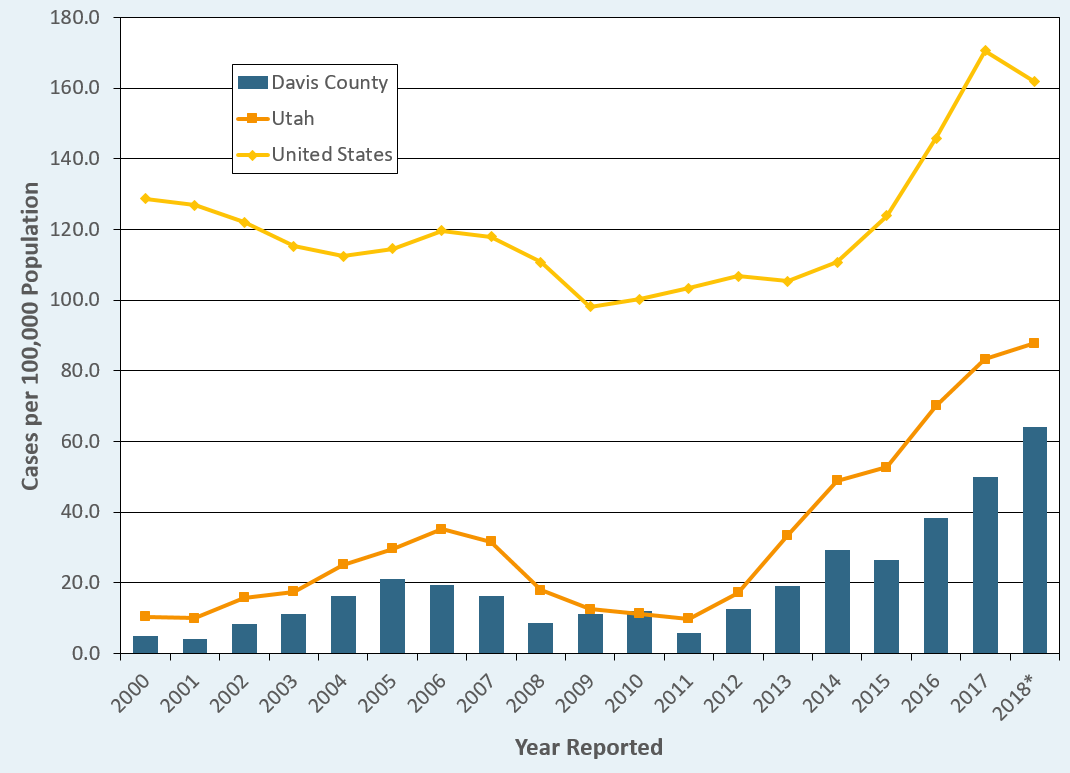

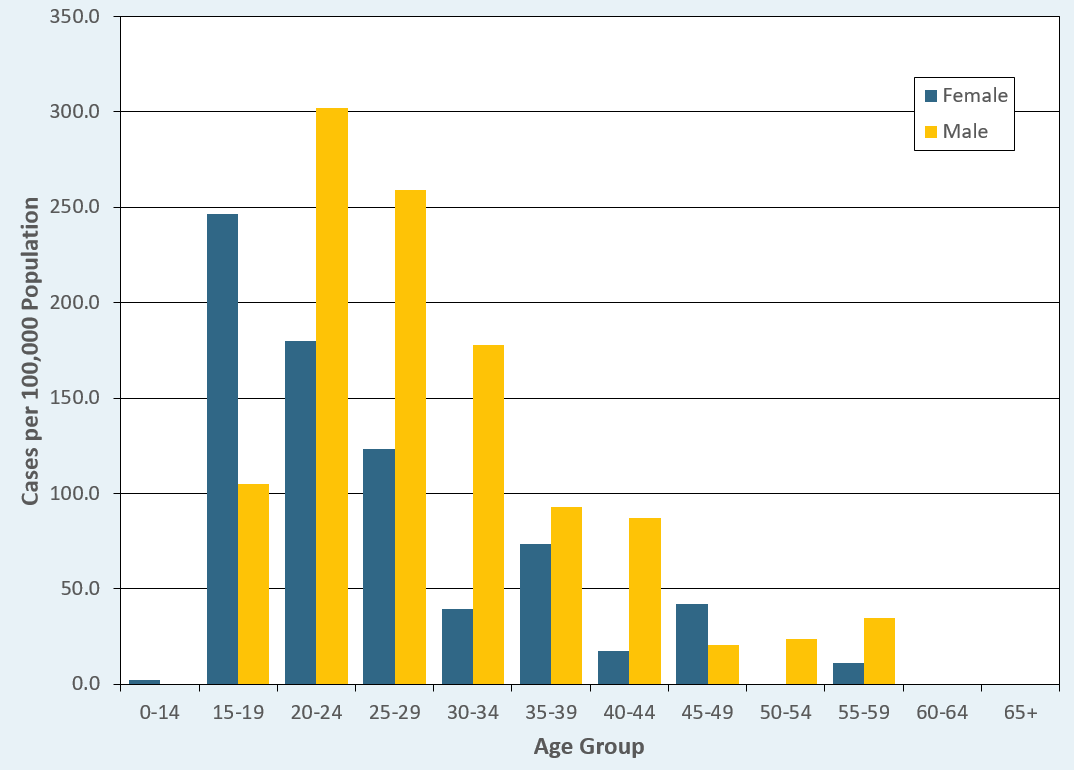

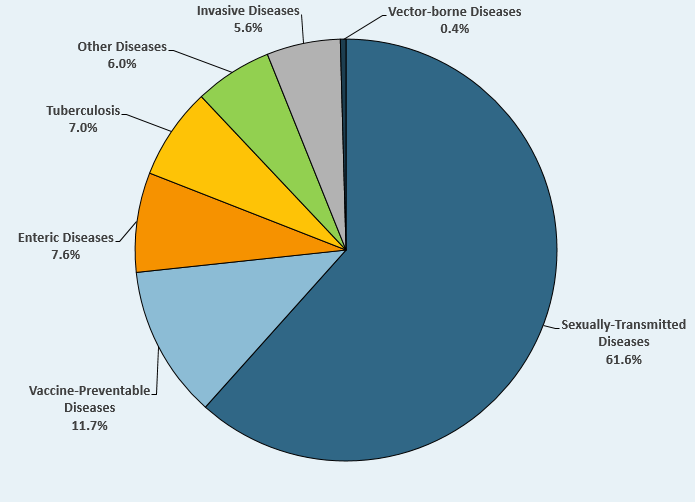

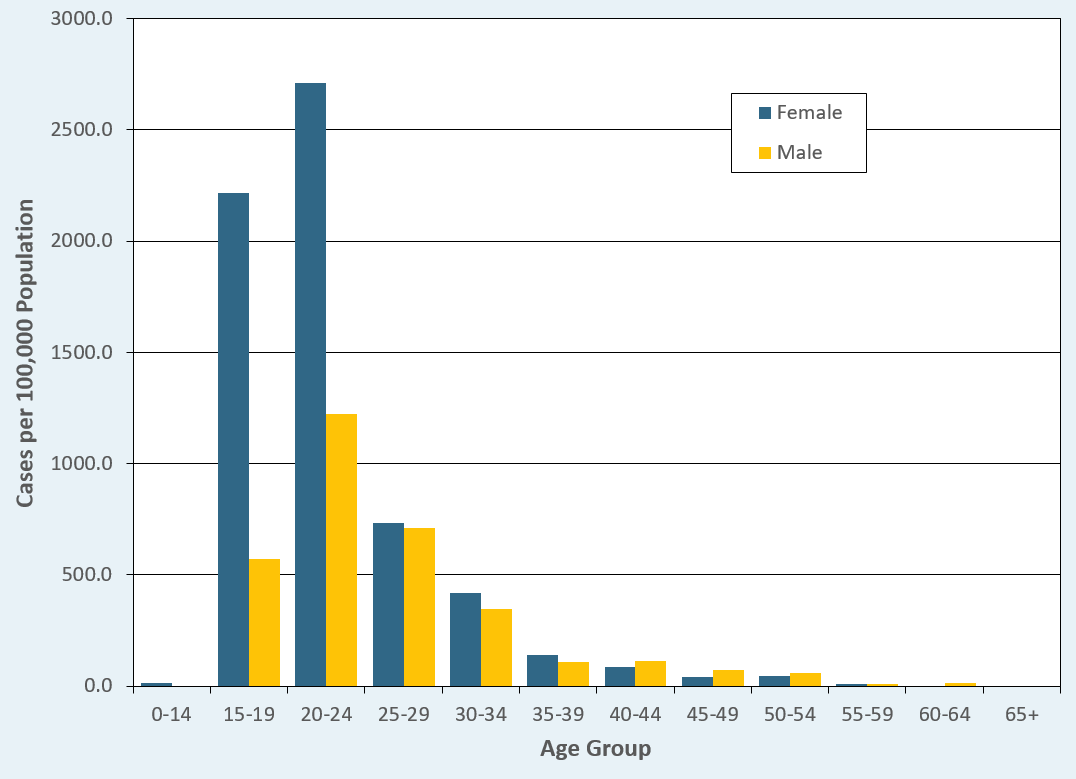

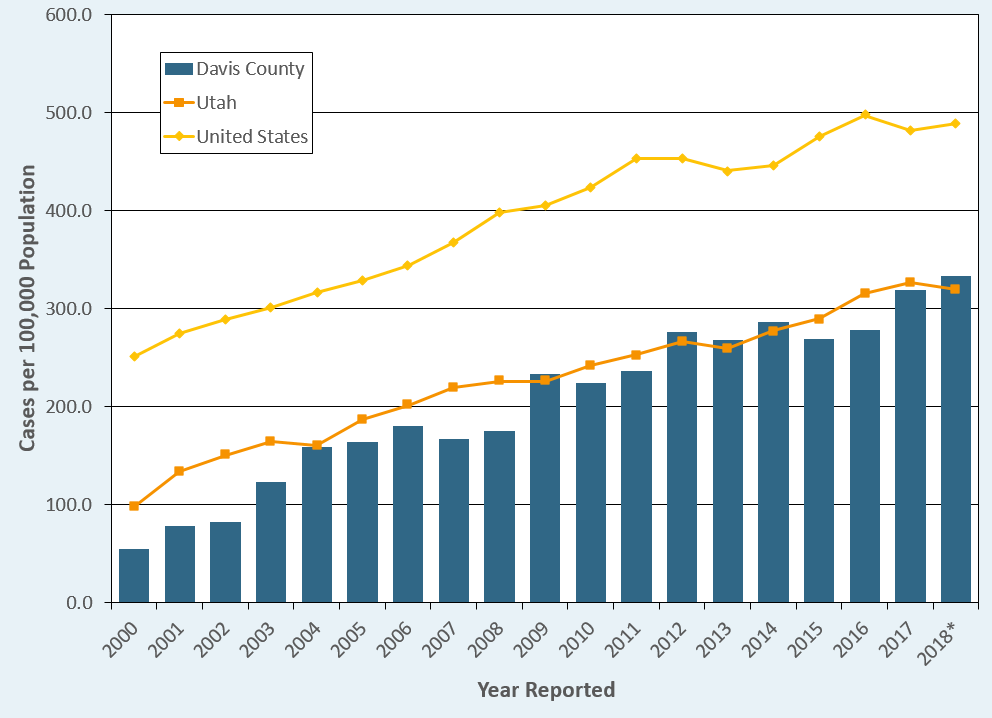

Sexually Transmitted Disease Highlights

Sexually Transmitted Disease Highlights

Sexually Transmitted Disease Highlights

Sexually Transmitted Disease Highlights